Robert Kiyosaki: A Financial Visionary and His Enduring Impact

Robert Kiyosaki is a name synonymous with financial wisdom and entrepreneurial success. As an American investor, businessman, author, and financial commentator with an estimated net worth of approximately $100 million as of April 2024[1], Kiyosaki has left an indelible mark on personal finance. His seminal book, “Rich Dad Poor Dad,” has sold millions of copies worldwide[2], inspiring countless individuals to take charge of their financial futures. While estimates of his net worth vary, there is no denying that his wealth is largely attributable to savvy investments and substantial real estate holdings[3]. This blog post delves into Kiyosaki’s financial philosophy, the lessons from his groundbreaking book, and the impact of his teachings on aspiring entrepreneurs and finance enthusiasts.

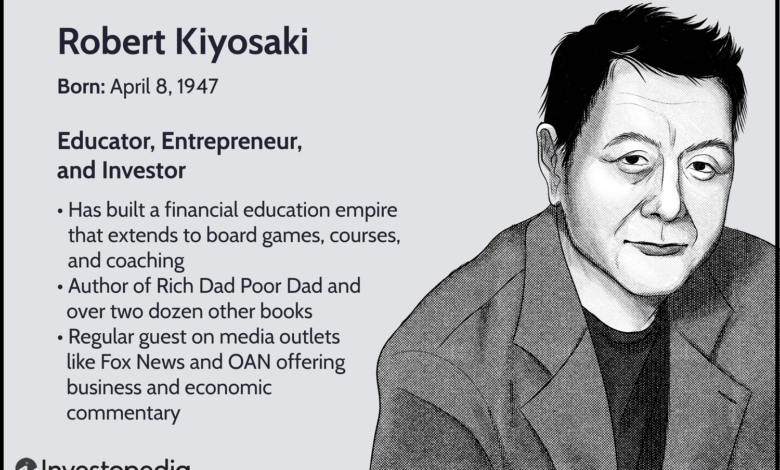

Introduction to Robert Kiyosaki

Robert Kiyosaki’s journey to financial success is a remarkable tale of perseverance, education, and strategic thinking. Born in Hilo, Hawaii, Kiyosaki’s early experiences with money were shaped by two influential figures: his “rich dad” and his “poor dad.” These mentors provided him with contrasting perspectives on wealth, work, and financial independence. “Rich Dad Poor Dad,” published in 1997, captured these lessons and catapulted Kiyosaki into the limelight, becoming a cornerstone of modern economic literature.

Exploring Kiyosaki’s Investment Philosophy

Kiyosaki’s investment philosophy revolves around financial education, risk management, and acquiring assets that generate passive income. Unlike traditional advice emphasising saving and job security, Kiyosaki advocates investing in real estate, businesses, and other income-producing investments. Here are some core tenets of his philosophy:

- Financial Education:

- Kiyosaki thinks that financial knowledge is the cornerstone for wealth accumulation. He urges people to learn about money, investing, and market movements. He believes that a lack of financial knowledge is the fundamental cause of many people’s financial struggles.

- Investing in Real Estate:

- Real estate is a key component of Kiyosaki’s investment approach. He sees property as a physical asset that can provide constant cash flow through rental revenue. Furthermore, real estate tends to rise over time, creating the opportunity for large cash. gains.

- Creating Passive Income:

- Kiyosaki emphasizes the importance of generating passive income—money earned with minimal effort. By investing in assets that produce regular returns, individuals can achieve financial freedom and reduce their reliance on traditional employment.

- Risk Management:

- While Kiyosaki advocates for taking calculated risks, he also underscores the importance of risk management. Diversification, thorough research, and market understanding are crucial to minimizing potential losses.

Lessons from “Rich Dad Poor Dad”

“Rich Dad Poor Dad” is more than simply a personal finance book; it’s a manifesto for anyone looking to achieve financial freedom. Here are some important lessons from the book that have resonated with readers globally:

- The Importance of Financial Education:

- Kiyosaki’s “rich dad” taught him that formal education alone is insufficient for financial success. Instead, continuous self-education about money and investments is crucial.

- Assets vs. Liabilities:

- One of the book’s main ideas is the separation between assets and liabilities. Kiyosaki describes assets as items that put money in your pocket, whereas liabilities take money out. Understanding the distinction is critical for wealth building.

- The Power of Entrepreneurship:

- Kiyosaki encourages readers to explore entrepreneurship as a path to financial freedom. Owning a business can provide greater control over one’s economic destiny than traditional employment.

- The Value of Taking Risks:

- Stepping out of one’s comfort zone and embracing calculated risks is essential for financial growth. Kiyosaki believes that fear of failure often prevents people from achieving their full potential.

Kiyosaki’s Net Worth: Sources and Controversies

Robert Kiyosaki’s net worth has been discussed and speculated about. As of April 2024, his net worth is expected to be $100 million [1]. This enormous wealth may be traced to three important sources:

- Books and Educational Products:

- The success of “Rich Dad Poor Dad” and its many sequels has resulted in enormous income. Kiyosaki’s financial education firm, Rich Dad firm, also provides seminars, coaching, and instructional materials, which supplement his income.

- Real Estate Investments:

- Kiyosaki’s real estate portfolio includes residential, commercial, and industrial properties. These investments provide steady rental income and have appreciated over time.

- Business Ventures:

- Over the years, Kiyosaki has ventured into various businesses, including oil drilling, mining, and tech startups. These endeavours have diversified his income streams and added to his wealth.

Despite his financial success, Kiyosaki’s net worth has faced scrutiny. Some critics question the accuracy of reported figures, suggesting that his true wealth may be lower. Regardless of the exact amount, Kiyosaki’s financial journey offers valuable lessons for entrepreneurs and investors.

The Impact of Kiyosaki’s Teachings

Robert Kiyosaki’s effect goes much beyond his financial achievement. His lessons have encouraged numerous others to take charge of their financial lives. Here are some real-life instances of people who followed Kiyosaki’s counsel and achieved financial success:

- Sarah, a Real Estate Investor:

- After reading “Rich Dad Poor Dad,” Sarah decided to invest in rental properties. She started with a small apartment and gradually expanded her portfolio. Today, Sarah owns multiple properties that generate passive income, allowing her to pursue her passion for travel.

- John, an Aspiring Entrepreneur:

- John was working a nine-to-five job when he discovered Kiyosaki’s book. Inspired by the lessons on entrepreneurship, he launched his own e-commerce business. With careful planning and persistence, John grew his venture into a profitable enterprise, providing him financial independence.

- Emma, a Financial Educator:

- Emma, a teacher by profession, recognized the importance of financial literacy after reading Kiyosaki’s work. She founded a financial education program for high school students, equipping the next generation with essential money management skills.

Conclusion

Robert Kiyosaki’s legacy on personal finance and entrepreneurship cannot be emphasized. His methods of financial education, investment, and wealth-building have helped many people realize their financial goals. Whether you’re an aspiring entrepreneur or a finance enthusiast, the lessons from “Rich Dad Poor Dad” remain as relevant today as they were when the book was first published.

As you begin your financial journey, keep in mind the necessity of continual learning, asset investment, and the power of smart risk-taking. By following Kiyosaki’s advice, you, too, may strive toward financial independence and a bright future.

For more insights and resources on building wealth and financial independence, explore Robert Kiyosaki’s extensive work and consider joining the vibrant community of individuals dedicated to economic success.

—

Sources:

[1] – Source for estimated net worth of Robert Kiyosaki as of April 2024.

[2] – Sales data and impact of “Rich Dad Poor Dad.”

[3] – Analysis of Kiyosaki’s investments and real estate holdings.